Sprintax Post-Filing FAQ

Major clearance:

FEDERAL TAX RETURN (FTR) and STATE TAX RETURN (STR) are two INDEPENDENT submissions, not related to the other. Imagine them as two different people you owed money to, so sending Federal Tax does not mean that you have done with your State Tax.

What is the deadline for tax payment and tax return?

- April 18. To secure your submission on time and prevent any penalties, please do everything by April 15. (Applicable for both FTR and STR).

What should I included in my Tax Return Package?

For Federal Tax:

- Tax Return Form.

- Form W-8BEN

- Form W-2

(Please refer to the instructions on the pdf. file generated on Sprintax for appropriate place to sign and other documents to include. For Federal Tax, those are on page 3 of the pdf).

For State Tax:

- Tax Return Form.

- Form W-2

(Please refer to the instructions on the pdf. file generated on Sprintax for appropriate place to sign and other documents to include. For State Tax, those are on page 3 of the pdf).

Address for Tax Returns.

In some cases, the federal tax pdf refers you to sending tax to the IRS in Charlotte, NC. ONLY send there if you decide to pay by check and include the check in the mailing envelope. Otherwise, please send it to this address:

Department of the Treasury

Internal Revenue Service

Austin, Texas 73301-0215

In some cases, the state tax pdf refers you to send tax to the Indiana Department of Revenue P.O. Box 7224. ONLY send there if you decide to pay by check and include the check in the mailing envelope. Otherwise, please send it to this address:

Indiana Department of Revenue

Individual Income Tax

P.O. Box 40

Indianapolis, IN 46206-0040

E-File and Related Questions.

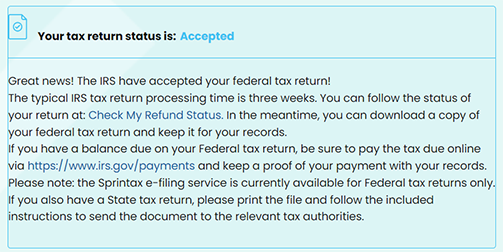

How to know if I have e-filed?

Log in to your Sprintax Return, select “Edit” on the corresponding year (2022) and see. If they have a box like this, then you are successfully e-filed! (Another case is a gray box which shows it is pending, it also mean that you have e-filed, but the IRS need time to review before accepting it.

Otherwise, you are not able to e-file and have to send the Federal Tax Return through mail.

What does it mean to be e-filed?

If you have e-filed, you do not need to mail your FEDERAL Tax Return (You still have to mail your STATE Tax Return to Indianapolis).

Payment method?

- Upon acceptance of your tax return (or April 15, whichever come first), please make a payment to the tax you owed (if you have). Again, remember FEDERAL and STATE are two different entities, so do not pay your FEDERAL liability to the STATE and vice versa.

- Instruction for FEDERAL Payment:

- Go to this website: https://www.irs.gov/payments

- If you have filed a tax return in 2021 or any prior year, you can choose the Direct Pay option (Note that merely filling form 8843 last year does not mean that you have done tax return in prior years).

- Otherwise (first time pay), please process to Pay now by Card or Digital Wallet.

- Follow their instructions. (Remember, you pay BALANCE DUE on this year 1040).

- Go to this website: https://www.irs.gov/payments