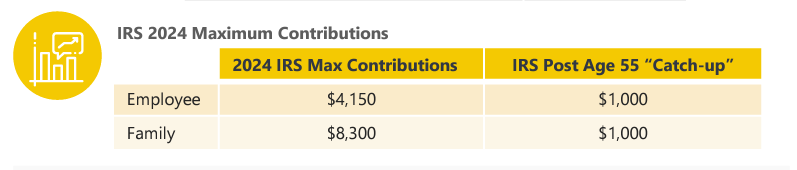

Employees may increase/decrease their health savings account (HSA) contributions throughout the calendar year from $0 up to the IRS limits. Employees should also keep in mind when making changes, that any contributions received from DePauw also counts towards the IRS maximum.

To make changes log into ADP portal (www.workforcenow.adp.com). Depending on the timing of your submission, changes can take one to two pay cycles to be reflected.

-

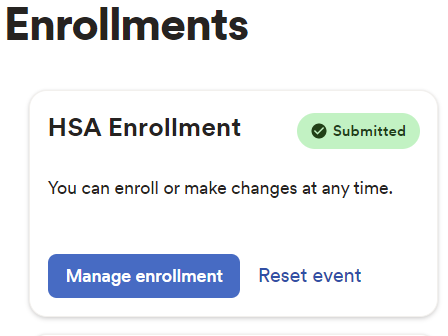

Go to MYSELF > Benefits > Enrollments

-

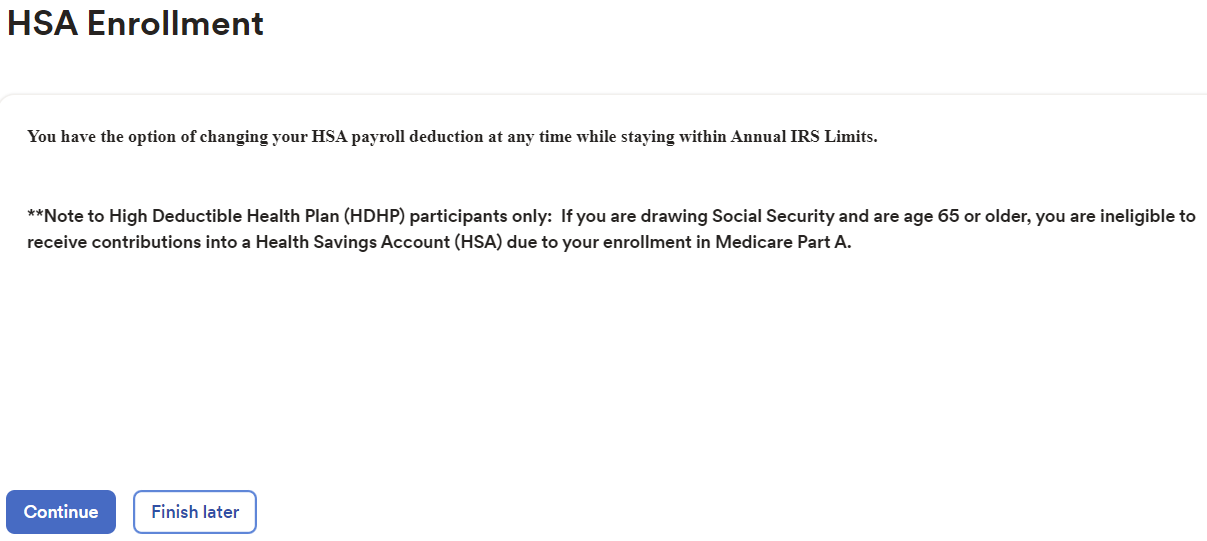

In the Year Round Enrollment box click on ENROLL NOW > MANAGE

-

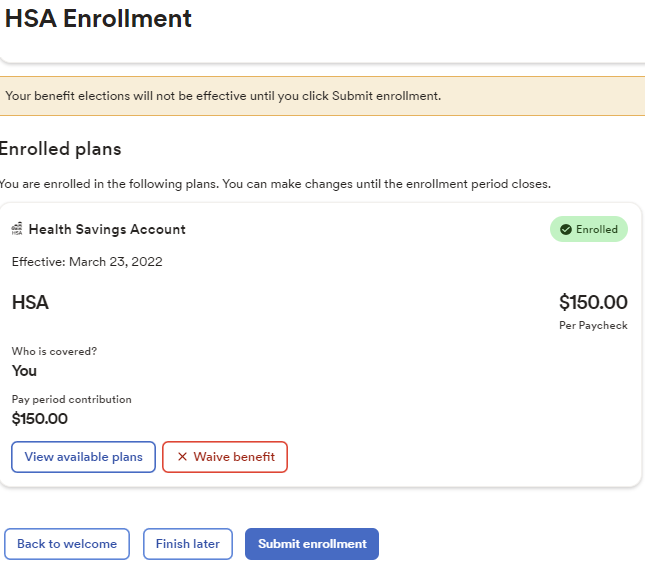

Click on VIEW AVAILABLE PLANS

-

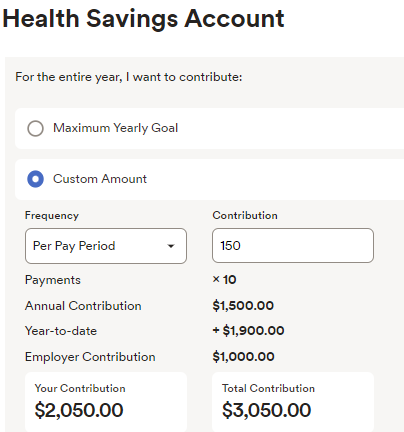

Select Custom Amount option, select Per Pay Period Frequency > Enter Contribution Amount > Preview and Confirm

-

Click on CLOSE to complete workflow request

Employees may check their HSA balances within the HSA Bank portal. Just a reminder to also designate at least one primary beneficiary while you are in the portal. Should you need assistance logging into the HSA portal contact HSA Bank customer service team directly at 800-357-6246.

How can you use your pre-tax HSA dollars? See the HSA Eligibility List for examples; keep in mind this is not all-inclusive.

Contact Human Resources if you have questions or need assistance at hr@depauw.edu or 765-658-4181.